maintenance

Federal Budget 2020–21: summary, resources and tools

By Robyn Jacobson, CTA, Senior Advocate at The Tax Institute

Now that the whirlwind of Budget week has passed, there is an opportunity to reflect on the implications of the measures announced in the Federal Budget 2020–21.

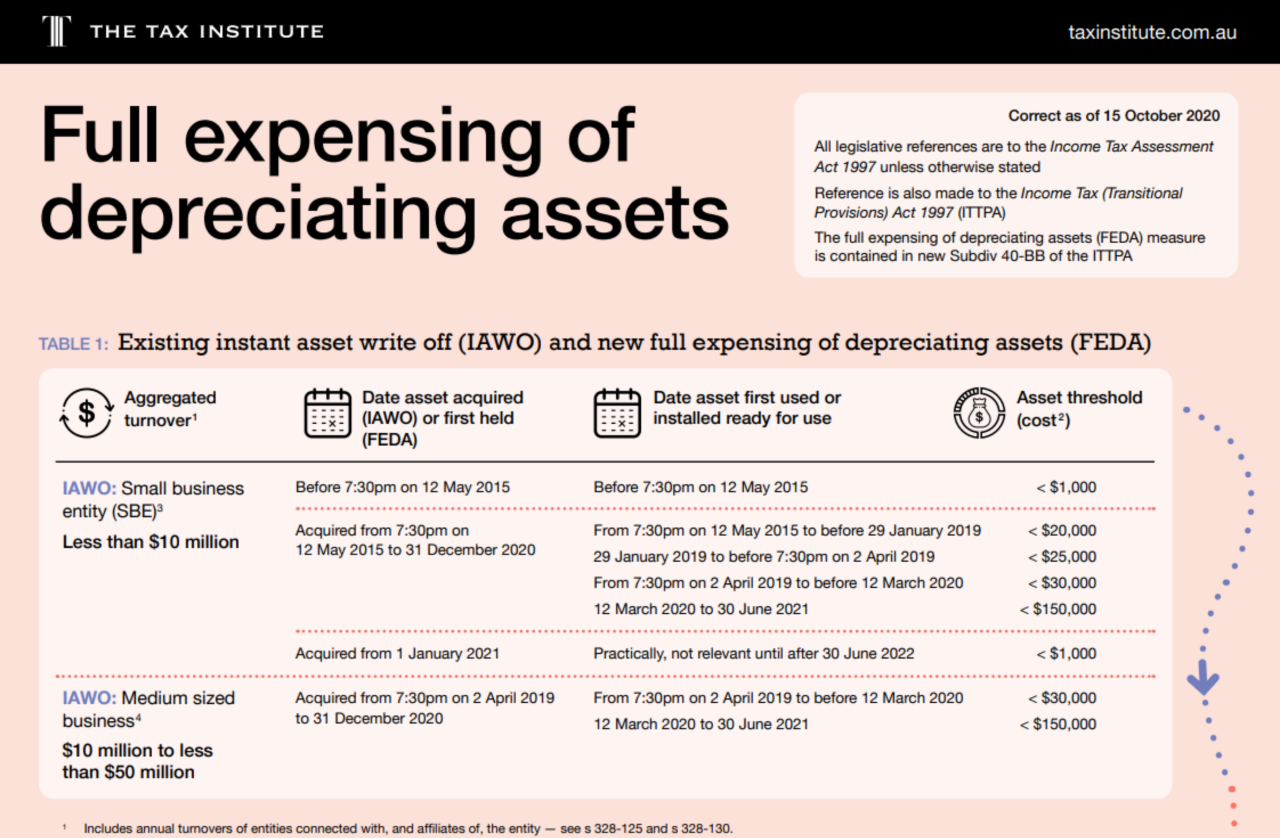

Some of the tax measures announced in the Federal Budget 2020—21 have proven to be complex and challenging for busy practitioners. Given that the Treasury Laws Amendment (A Tax Plan for the COVID-19 Economic Recovery) Act 2020 has been enacted (on 14 October 2020 as Act No. 92 of 2020) it’s important for tax practitioners to understand the new measures affecting depreciating assets and their practical application.

To assist our members, I have analysed the recent legislative amendments and collated the most important information into the summary and infographics below, which contain a series of practical reference tables to assist in applying the new Budget measures.

Key measures

- Personal income tax cuts — Schedule 1 to the Budget Act

- Expanded access to small business tax concessions — Schedule 3 to the Budget Act

- Full expensing of depreciable assets — Schedule 7 to the Budget Act

- Temporary loss carry back — Schedule 2 to the Budget Act

- Changes to the R&D tax offset — Schedules 4–6 to the Budget Act

- CGT exemption for eligible granny flat arrangements

Personal income tax cuts

Tax rates tables

The enacted rates and thresholds are summarised in the tables below.

Residents

TABLE 1: Summary of individual income tax rates

To 30 June 2018 | STAGE 1 | STAGE 2 | STAGE 3 | ||||

|---|---|---|---|---|---|---|---|

Income threshold | Tax rate above threshold | Income threshold | Tax rate above threshold | Income threshold | Tax rate above threshold | Income threshold | Tax rate above threshold |

$18,200 | 19% | $18,200 | 19% | $18,200 | 19% | $18,200 | 19% |

$37,000 | 32.5% | $37,000 | 32.5% | $45,000 | 32.5% | $45,000 | 30% |

$87,000 | 37% | $90,000 | 37% | $120,000 | 37% | $200,000 | 45% |

$180,000 | 45% | $180,000 | 45% | $180,000 | 45% | ||

TABLE 2: Individual income tax rates: 2019–20

Taxable income | Marginal rate | Tax on this income |

|---|---|---|

$0–$18,200 | Nil | Nil |

$18,201–$37,000 | 19% | 19 cents for each $1 over $18,200 |

$37,001–$90,000 | 32.5% | $3,572 plus 32.5 cents for each $1 over $37,000 |

$90,001–$180,000 | 37% | $20,797 plus 37 cents for each $1 over $90,000 |

$180,001 and over | 45% | $54,097 plus 45 cents for each $1 over $180,000 |

TABLE 3: Individual income tax rates: 2020–21

Taxable income | Marginal rate | Tax on this income |

|---|---|---|

$0–$18,200 | Nil | Nil |

$18,201–$45,000 | 19% | 19 cents for each $1 over $18,200 |

$45,001–$120,000 | 32.5% | $5,092 plus 32.5 cents for each $1 over $45,000 |

$120,001–$180,000 | 37% | $29,467 plus 37 cents for each $1 over $120,000 |

$180,001 and over | 45% | $51,667 plus 45 cents for each $1 over $180,000 |

TABLE 4: Income tax offsets

Offset | STAGE 1 — From 1 July 2018 | STAGE 2 — From 1 July 2020 | ||

|---|---|---|---|---|

Taxable income | Rate | Taxable income | Rate | |

LITO | $0–$37,000 | $445 | $0–$37,500 | $700 |

$37,000–$66,667 | $445 less 1.5 cents for every $1 by which the taxable income exceeds $37,000 | $37,501–$45,000 | $700 less 5 cents for every $1 by which the taxable income exceeds $37,500 | |

$45,001–$66,667 | $325 less 1.5 cents for every $1 by which the taxable income exceeds $45,000 | |||

Over $66,667 | Nil | Over $66,667 | Nil | |

LMITO | $0–$37,000 | $255 | LMITO available only until 1 July 2021 | |

$37,001–$48,000 | $255 plus 7.5% of the amount of the income that exceeds $37,000 | |||

$48,001–$90,000 | $1,080 | |||

$90,001–$126,000 | $1,080 less 3% of the amount of the income that exceeds $90,000 | |||

$126,001 and over | Nil | |||

Non-residents

TABLE 5: Individual income tax rates: 2019–20

Taxable income | Marginal rate | Tax on this income |

|---|---|---|

$0–$90,000 | 32.5% | 32.5 cents for each $1 |

$90,001–$180,000 | 37% | $29,250 plus 37 cents for each $1 over $90,000 |

$180,001 and over | 45% | $62,550 plus 45 cents for each $1 over $180,000 |

TABLE 6: Individual income tax rates: 2020–21

Taxable income | Marginal rate | Tax on this income |

|---|---|---|

$0–$120,000 | 32.5% | 32.5 cents for each $1 |

$120,001–$180,000 | 37% | $39,000 plus 37 cents for each $1 over $120,000 |

$180,001 and over | 45% | $61,200 plus 45 cents for each $1 over $180,000 |

Working holiday makers

TABLE 7: Individual income tax rates: 2019–20

Taxable income | Marginal rate | Tax on this income |

|---|---|---|

$0–$37,000 | 15% | 15 cents for each $1 |

$37,001–$90,000 | 32.5% | $5,550 plus 32.5 cents for each $1 over $37,000 |

$90,001–$180,000 | 37% | $22,775 plus 37 cents for each $1 over $90,000 |

$180,001 and over | 45% | $56,075 plus 45 cents for each $1 over $180,000 |

TABLE 8: Individual income tax rates: 2020–21

Taxable income | Marginal rate | Tax on this income |

|---|---|---|

$0–$45,000 | 15% | 15 cents for each $1 |

$45,001–$120,000 | 32.5% | $6,750 plus 32.5 cents for each $1 over $45,000 |

$120,001–$180,000 | 37% | $31,225 plus 37 cents for each $1 over $120,000 |

$180,001 and over | 45% | $53,325 plus 45 cents for each $1 over $180,000 |

Effect of tax cuts

Bringing forward Stage 2 of the already legislated Personal Income Tax Plan from 1 July 2022 to 1 July 2020 will result in an increase in post-tax income for 2020–21 (compared to the tax payable for 2017–18) for most individual taxpayers.

This is summarised in the following table.

TABLE 9: Increase in post-tax income in 2020–21

Taxable income | Tax payable at 2017–18 rates* | Tax payable at 2020–21 rates* | Reduction in tax |

|---|---|---|---|

$30,000 | $1,797 | $1,542 | $255 |

$50,000 | $7,547 | $5,387 | $2,160 |

$100,000 | $24,632 | $22,187 | $2,445 |

$120,000 | $32,032 | $29,287 | $2,745 |

$150,000 | $43,132 | $40,567 | $2,565 |

$200,000 | $63,232 | $60,667 | $2,565 |

*Excludes Medicare levy but includes benefit of Low income tax offset and Low and middle income tax offset

Delivery of tax cuts

The Taxation Administration Act Withholding Schedules No. 2 2020 were registered on 12 October 2020. The withholding schedules specify the updated formulas and procedures to be used for working out the amount of PAYG withholding following the changes in the marginal tax rates.

The ATO has released new PAYG withholding tax tables which take effect from 13 October 2020. These adjust the withholding schedules and tax tables to incorporate the changes to personal income tax thresholds for 2020–21 announced by the Government during the Federal Budget. They apply to payments made on and from 13 October 2020.

As the changes to PAYG withholding for 2020–21 have been made part way through the income year, employers and other payers who are unable to immediately implement these changes into their payroll will have until 16 November 2020 to do so.

The ATO does not consider it would be appropriate to adjust the tables for any over-payments of tax in the first four months of the income year and further reduce the PAYG withholding in the remaining eight months of the year. There is a risk of under-withholding when trying to squeeze 12 months of tax cuts into eight months for people with variable employment patterns.

Unquestionably, over-payments of tax will result from the mid-stream change in the income thresholds, but employees and other payees will receive their entitlement to the reduced tax payable for the entire 2020–21 income year when they lodge their 2021 income tax return.

This has created the perception for some that the tax cuts will not have an immediate benefit for taxpayers. However, this overlooks the reduction in PAYG withholding amounts that will affect payroll amounts from 13 October 2020.

Expanded access to small business tax concessions

Access to 10 small business tax concessions previously available only to small business entities1 has been expanded to include businesses with an aggregated annual turnover of $10 million to less than $50 million.

TABLE 10: Expanded small business tax concessions

Concession | Legislative reference | Start date |

|---|---|---|

Immediate deduction for certain start-up expenses | s 40-880(2A) of the ITAA 1997 | 1 July 2020 |

Immediate deduction for certain prepaid expenditure | s 82KZM of the ITAA 1936 | 1 July 2020 |

FBT exemption for car parking benefits | s 59GA of the FBTA 1986 | 1 April 2021 |

FBT exemption for multiple work-related portable electronic devices | s 58X(2)(a) and s 58X(4) of the FBTA 1986 | 1 April 2021 |

Simplified trading stock rules | Subdiv 328-E of the ITAA 1997 | 1 July 2021 |

Remit PAYG instalments based on GDP-adjusted notional tax | s 45-130(1)(d) of Schedule 1 to the TAA 1953 | 1 July 2021 |

Settle excise duty monthly on eligible goods | s 61C of the Excise Act 1901 | 1 July 2021 |

Settle excise-equivalent customs duty monthly on eligible goods2 | s 69 of the Excise Act 1901 | 1 July 2021 |

Two-year amendment period | Item 2 of the table in s 170(1) of the ITAA 1936 | 1 July 2021 |

Simplified accounting method determination for GST purposes | s 123-5 of the GSTA 1999 | 1 July 2021 |

Full expensing of depreciable assets

The date by which an entity must first use or install ready for use an asset acquired by 31 December 2020 in order to claim the existing instant asset write off (IAWO)3 has been extended by six months to 30 June 2021. This extension does not change the requirement that the asset must be acquired by 31 December 2020.

A new measure allows businesses with an aggregated turnover of less than $5 billion to fully expense a depreciating asset (FEDA)4 the entity starts to hold from 7:30pm on 6 October 2020, provided it is first used or installed ready for use by 30 June 2022.

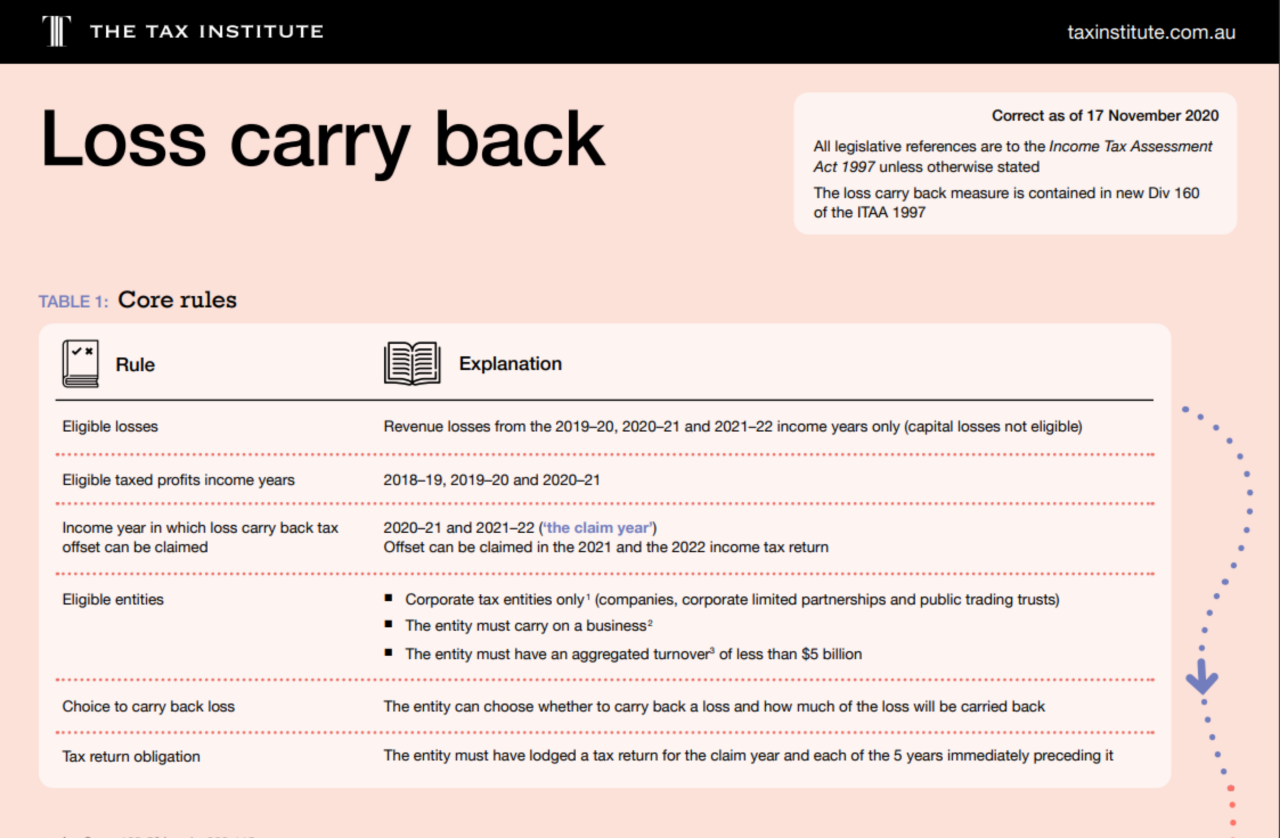

Temporary loss carry back

The new loss carry back measure will allow corporate tax entities (CTE) to carry back tax losses from the 2019–20 to 2021–22 income years against taxed profits from the 2018–19 to 2020–21 income years. The tax is claimed by way of a refundable tax offset — a loss carry back tax offset — which is claimed in the 2020–21 and 2021–22 tax returns only.

The temporary rules will cease to apply after the 2021–22 income year.

Calculating the loss carry back tax offset

TABLE 13: Calculating the loss carry back tax offset

Step 1 | Identify loss from 2019–20 to 2021–22 that can be carried back against taxed profits from 2018–19 to 2020–21 |

Step 2 | Reduce loss to be carried back by exempt income (if any) |

Step 3 | Loss carry back tax offset component — convert loss to tax equivalent amount (× corporate tax rate for loss year): If the CTE is a base rate entity, use:

Otherwise use 30% |

Step 4 | Determine balance in franking account at the end of the year in which the offset is claimed |

Step 5 | (Refundable) loss carry back tax offset is the lesser of Step 3 and Step 4 |

Step 6 | Claim the loss carry back by the time the 2020–21 or 2021–22 income tax return is lodged (it is expected the choice to carry back a loss will be made in the tax return) |

Key points

Applies to corporate tax entities only i.e. a company, corporate limited partnership or public trading trust (not sole traders, partnerships or trusts).

Entity must carry on a business.

Many businesses with a domestic turnover of less than $5 billion may nevertheless be ineligible for this measure due to foreign ownership interests. The entity’s annual turnover is grouped with that of its affiliates and entities connected with it, which may cause the entity’s aggregated turnover to be $5 billion or more.

Revenue losses only (capital losses cannot be carried back as the CGT regime operates on a realisation basis).

The entity must have lodged a tax return for the year of claim and each of the 5 years immediately preceding it. In certain cases where the CTE might not have been required to lodge a return for a year, this will not prevent an entity from being entitled to a loss carry back tax offset.

A CTE can choose:

- the amount of the loss to carry back; or

- to carry the loss forward to offset again future taxable profits (subject to continuity of ownership test or same/similar business test)

An integrity rule applies to deny the loss carry back tax offset where a scheme has been entered into for a purpose of obtaining the offset.

Download our handy infographic below to help you understand and apply these rules and core principles.

Changes to the R&D tax offset

The changes to the R&D tax offset apply from 1 July 2021.

TABLE 14: R&D tax offset

Aggregated turnover of R&D entity | R&D tax offset rate to 2020–21 | R&D spend as % of total expenditure | Premium | R&D tax offset rate from 2021–22 | |

|---|---|---|---|---|---|

Corporate tax rate: 25% | Corporate tax rate: 30% | ||||

Less than $20m | Refundable 43.5% tax offset | Not applicable | 18.5% | 43.5% | 48.5% |

$20m or more, or controlled by exempt entities | Non-refundable 38.5% tax offset | 0–2% More than 2% | 8.5% 16.5% | 33.5% 41.5% | 38.5% 46.5% |

Note

- Proposed $4 million cap on the refundable tax offset for small R&D entities is not proceeding.

- The R&D expenditure threshold will increase from $100 million to $150 million.

CGT exemption for eligible granny flat arrangements

An exemption will apply to disregard the CGT implications of creating, varying or terminating a formal written granny flat arrangement. This will remove the adverse tax consequences for the homeowner.

This is not a blanket CGT exemption for all granny flats. The exemption will apply only in respect of a granny flat interest6 for a property that is the principal home7 of the taxpayer. The exemption will not be available for a rental property that happens to contain a granny flat.

The exemption will apply from the first 1 July following the date of Royal Assent of enabling legislation.

Enabling legislation is yet to be introduced into Parliament, but it is expected that the exemption will apply to disregard capital gains from arising under:

- CGT event D1 (creation of contractual rights) where a lump sum is paid to the homeowner; and

- CGT event C2 (cancellation or ending of rights).

It is not expected that a CGT exemption will apply to prevent the partial loss of the main residence exemption where the homeowner receives rent under the granny flat arrangement.

Disclaimer

The material and opinions in the paper should not be used or treated as professional advice and readers should rely on their own enquiries in making any decisions concerning their own interests

Footnotes

1 Defined in s 328-110 of the ITAA 1997 as an entity that, broadly, carries on a business and has an aggregated annual turnover of less than $10 million.

2 Eligible small businesses can currently apply to defer settlement of excise duty and excise-equivalent customs duty from a weekly to a monthly reporting cycle. See ATO web guidance.

3 Rules are contained in s 40-82 and Subdiv 328-D of the ITAA 1997, and s 328-180 of the Income Tax (Transitional Provisions) Act 1997.

4 Rules are contained in Subdiv 40-BB of the Income Tax (Transitional Provisions) Act 1997.

5 Applies to entities with an aggregated turnover of less than $500 million where the entity starts to start to hold the asset, and starts to use it or has it installed ready for use for a taxable purpose, between 12 March 2020 to 30 June 2021. The rules are contained in Subdiv 40-BA of the Income Tax (Transitional Provisions) Act 1997.

6 Within the meaning of s 12A of the Social Security Act 1991.

Correct as of 12 October 2020

Tagged

- 2021

- 2020

- Federal Budget